Consumer Insight As A Leading Indicator

Subscribe to our Payments Innovation Blog for data and insights on your competitors and customer segments.

Contact Us

Payments Turmoil & How Consumer Insight Can Act As A Leading Indicator for Preserving Share

Rewind The Tape Case Study

Consumer insight can be a powerful leading indicator for uncovering emerging trends and stimulating decisions that propel companies ahead of the curve.

Here is an example of how our data uncovered key innovation trends a month before consumer behaviors took hold and companies reacted.

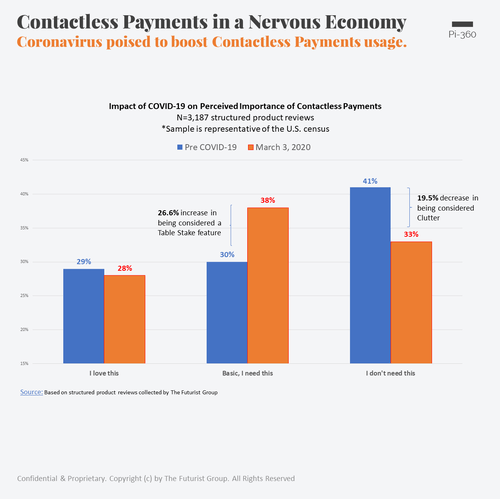

MARCH 3rd | CONTACTLESS PAYMENTS SPIKE IN IMPORTANCE 2 WEEKS BEFORE SHUT DOWN

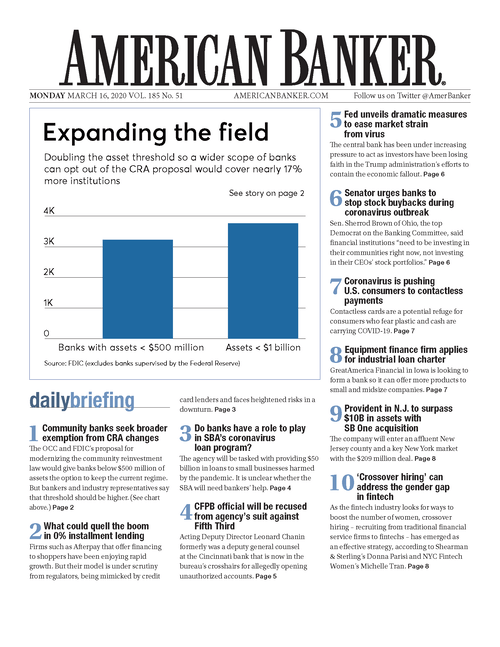

The Futurist Group identifies a spike in consumer interest for Contactless Payments. On the same day, the World Health organization notes the potential risk in handling cash. Our data and insights are featured by American Banker.

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Sources for this blog: The Futurist Group, TechCrunch, Forbes

MARCH 19th | SHUT DOWN COMMENCES, CONSUMER INSIGHT FROM 14K+ REVIEWS AVAILABLE

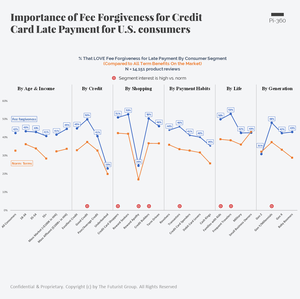

On March 19th, as the U.S. commences a national shut down, The Futurist Group releases data from 14,000+ structured product reviews indicating the importance of Deferrals as well as specific Rewards strategies for protecting payments volume and share.

Our segment-level insights are benchmarked against every payments feature currently on the market, as well as innovative features that are yet to be released.

SOME OF THE KEY TAKEAWAYS:

- Multiple consumer segments desire targeted rewards as a form of Financial Support

- Connecting Rewards to COVID-related charity donation will motivate long-term engagement among key segments

- Reorienting rewards and partner benefits to relevant purchases (shopping for household supplies, streaming, grocery delivery, etc.) will preserve payments share

Click on any of the images below to enlarge:

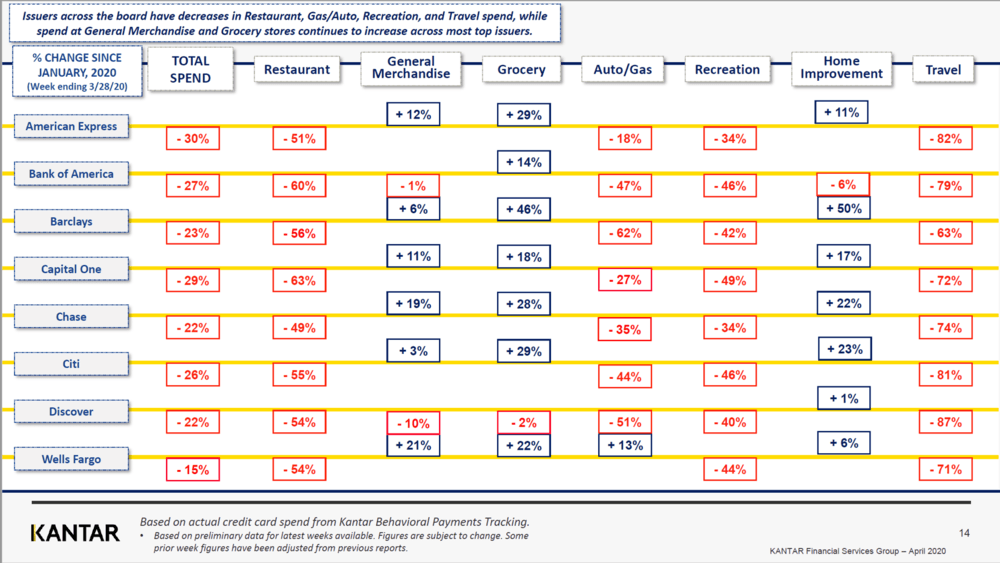

MARCH 28th | CREDIT CARD SPEND DROPS BY AS MUCH AS -30% FOR ISSUERS

Kantar’s Behavioral Payments Panel that tracks actual spend data across credit and debit accounts, shows significant but varying drops in Payments Volume across portfolios:

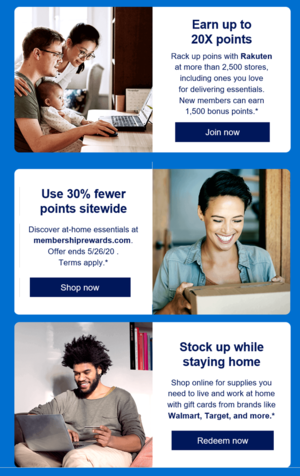

APRIL 23rd | ISSUERS ARE STARTING TO MAKE CHANGES

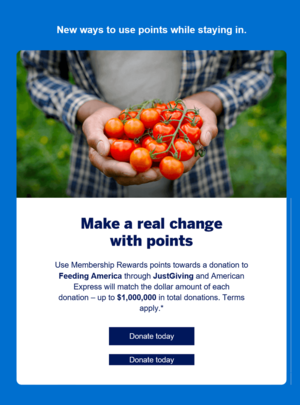

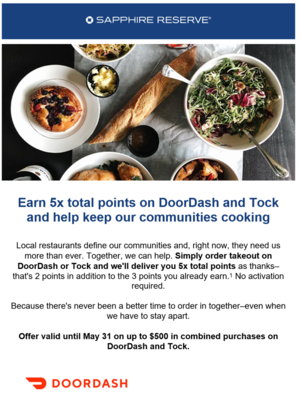

With volume down, and some losing share faster than others, AMEX is one of the first issuers to put a holistic targeted offer that incorporates all the insights uncovered on MARCH 19th. Chase and others are following suit.

WHAT COMES NEXT? | ACCESS OUR DYNAMIC DATA & METHODOLOGY TO IDENTIFY TRENDS AND PRACTICAL ACTIONS THAT WILL HELP YOU STAY AHEAD OF THE CURVE

- Access dynamic and custom analytics on every payments feature currently on the market

- Access reports on every competitor and their product

- Engage thousands of consumers in hours, not in weeks

Contact Us

Peruse our Reports (On Demand Consumer Insight on Every Product & Feature on the Market)

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Read About Our Road to Recovery Index: The best predictors of future outcomes combine behavioral and economic data with consumer sentiment. This is why we are partnering with Kantar Behavioral Payments Tracking and Pollfish to help our clients evaluate the near-term impact of COVID-19 on consumer expenditures. By combining actual spend patterns with economic and consumer sentiment data, we are creating forward-looking analytics that provide deeper context for where we are today and the path that we will need to take on the Road to Recovery.

Sources: The Futurist Group, Kantar Behavioral Payments Tracking