Road to Recovery Index: April Spend Validation

Subscribe to our Payments Innovation Blog for data and insights on your competitors and customer segments.

Contact Us

Road to Recovery Index Validation

Consumer Discretionary Spend on Track to Decline by 32% in April

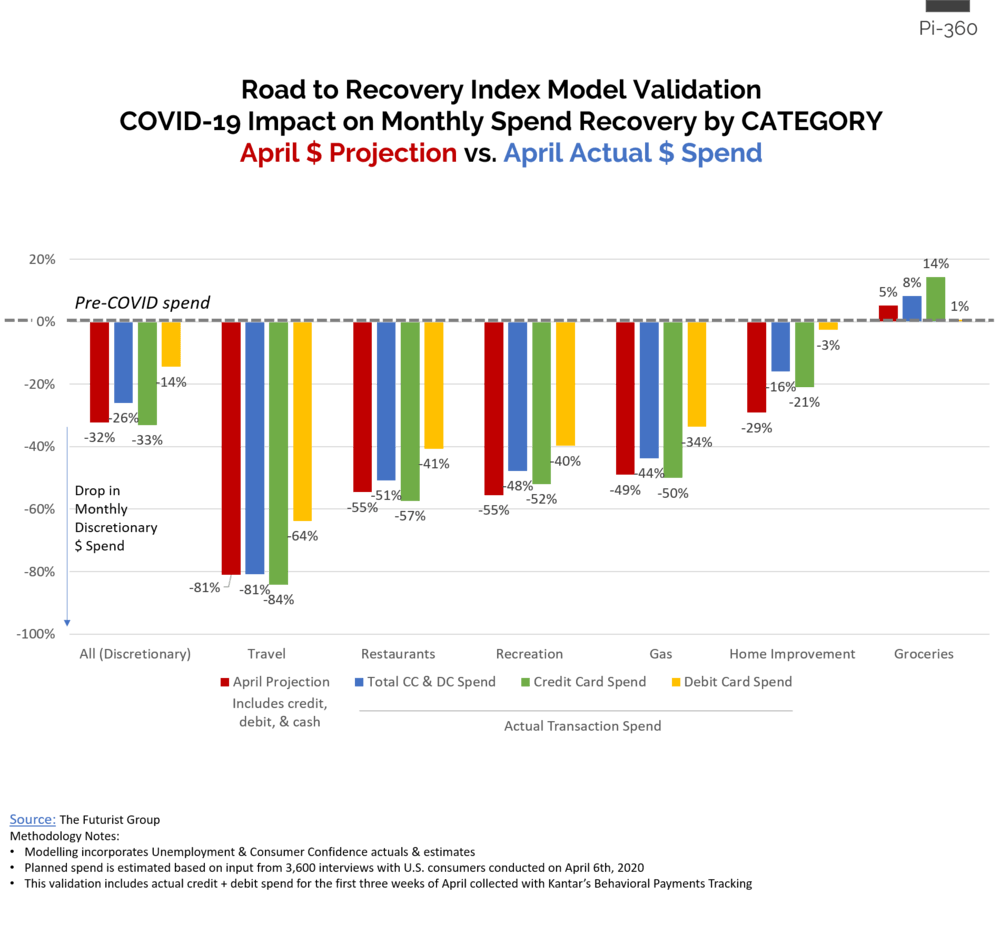

As part of our Road to Recovery Index, we projected that by the end of April, discretionary spend would to drop by 32% or $105 billion dollars.

In the analysis below, we start to validate our model with actual credit and debit transaction data collected by Kantar’s Behavioral Payments Tracking.

This analysis includes actual credit and debit transaction data through April 18th, 2020.

Year-over-year change is calculated with the week ending April 20th, 2019.

Recovery Index projections include all payment methods, including cash.

KEY TAKEAWAYS:

- Actual credit + debit spend has declined 26%. Given that cash usage is disproportionately impacted by social distancing, we are holding firm with our -32% projection.

- Our projections for Travel, Restaurants, Recreation, Gas, and Groceries are proving accurate.

- On a positive note, we are seeing better than expected results in Home Improvement.

- For the first three weeks of the month, debit card spend was more resilient (-14%) than credit card spend (-33%).

WHAT COMES NEXT? | ACCESS OUR DYNAMIC DATA & METHODOLOGY TO IDENTIFY TRENDS AND PRACTICAL ACTIONS THAT WILL HELP YOU STAY AHEAD OF THE CURVE

- Access dynamic and custom analytics on every payments feature currently on the market

- Access reports on every competitor and their product

Contact Us

Peruse our Reports (On Demand Consumer Insight on Every Product & Feature on the Market)

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Read About Our Road to Recovery Index: The best predictors of future outcomes combine behavioral and economic data with consumer sentiment. This is why we are partnering with Kantar Behavioral Payments Tracking and Pollfish to help our clients evaluate the near-term impact of COVID-19 on consumer expenditures. By combining actual spend patterns with economic and consumer sentiment data, we are creating forward-looking analytics that provide deeper context for where we are today and the path that we will need to take on the Road to Recovery.

Sources: The Futurist Group, Kantar Behavioral Payments Tracking