Will Travel Return?

Subscribe to our Payments Innovation Blog for data and insights on your competitors and customer segments.

Contact Us

Will Travel Spend Return?

Travel Card Engagement Strategy

A Message of Hope

Road to Recovery Index Model

Recently, we released a Road to Recovery Index Model that helps us project the shape of the Payments volume recovery coming out of the COVID-19 pandemic. Our approach is unique as we combine actual spend data with consumers’ willingness and ability to resume their purchase behaviors after the economy reopens.

Our purpose with this analysis, as with everything else that we do, is to provide portfolio managers with actionable insights and recommendations that can help preserve their payments share during this difficult time.

The Recovery Index quantifies the extent of the devastation on the travel category, and while the road ahead is difficult, there is a glimmer of hope.

KEY TAKEAWAYS:

- Monthly travel spend is projected to drop by -81% by the end of April.

- We evaluated two re-opening conditions with consumers, a June reopen, and an August reopen. Both conditions assume a ‘best case’ scenario where social distancing measures are lifted and there are minimal restrictions on travel.

- With a June reopen, monthly Travel spend improves, but stays contracted at -13% vs. pre-COVID levels.

- With an August reopen, monthly spend improves, but stays contracted at -22%.

- This analysis shows that as long there is no medical solution in place, infection fears will have a lasting impact on monthly spend patterns.

- However, there is a glimmer of hope in that consumers do want to return to normal, and that spend will resume.

- In fact, in certain sub-sectors like the Cruise line industry, there is a surge in online bookings for 2021. [1]

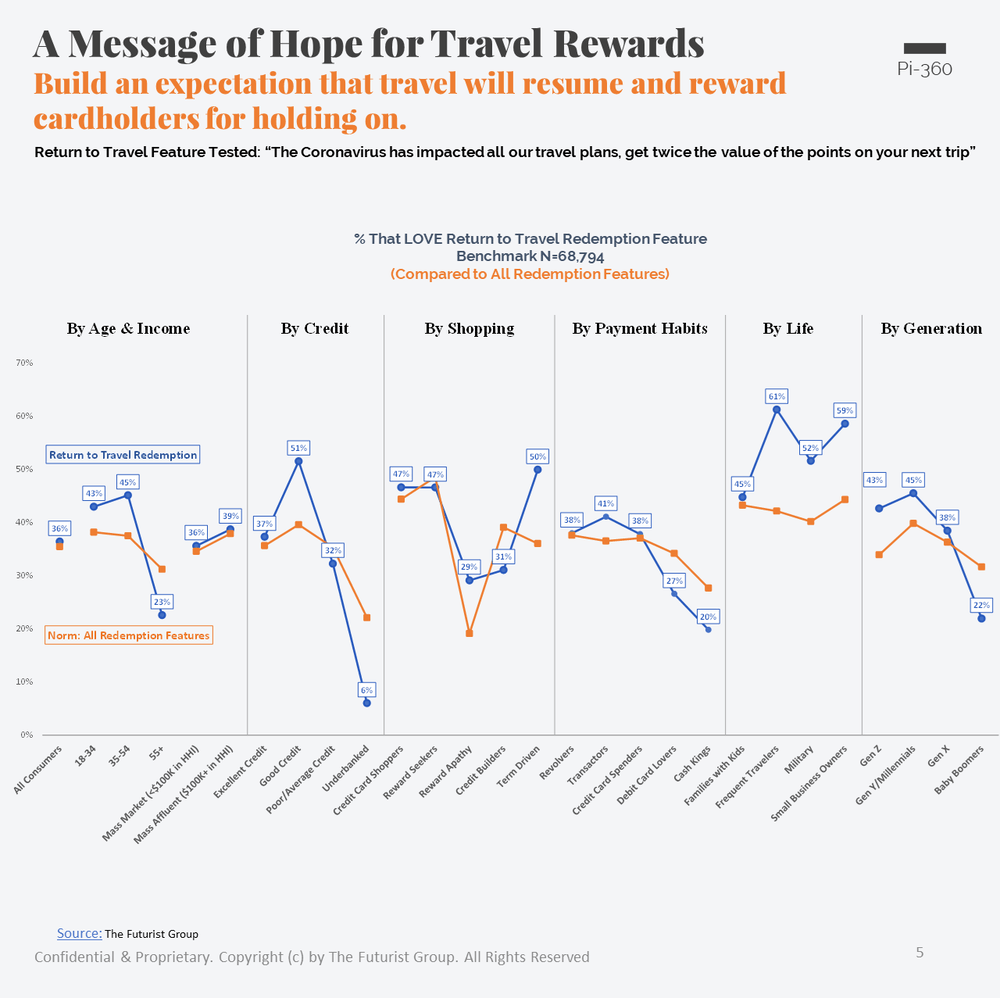

Leveraging our always-on Payments benchmarking, here is an example of the type of Travel reward communication strategy that is performing better than all Travel / Redemption benefits that are currently on the market.

KEY TAKEAWAY:

- A successful strategy will need to connect to consumers’ yearning for that first trip back.

- Assigning a reward for a ‘return to normalcy’, will motivate current engagement.

- Maintaining top of wallet relevancy in this climate is very difficult for a travel portfolio at this juncture. While this exact execution may be prohibitively expensive, a targeted and tailored variation of this approach can help managers retain and engage their customers.

Review our full approach and methodology for the Road to Recovery Index.

The expense categories covered in this model have accounted for approximately ~$3.96 trillion in 2019 consumer expenditures or ~29.5% of total Personal Consumer Expenditures (PCE).

This model is designed to be updated on a monthly basis, and can be incorporated into broader econometric forecasts.

Contact Us

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Road to Recovery Index: The best predictors of future outcomes combine behavioral and economic data with consumer sentiment. This is why we are partnering with Kantar Behavioral Payments Tracking and Pollfish to help our clients evaluate the near-term impact of COVID-19 on consumer expenditures. By combining actual spend patterns with economic and consumer sentiment data, we are creating forward-looking analytics that provide deeper context for where we are today and the path that we will need to take on the Road to Recovery.

Sources: The Futurist Group, U.S. Bureau of Economic Analysis

1. LA Times: Believe it or not, people are still booking cruises for next year