Road to Recovery Index - Restaurant Facts

Contact Us

Dining Is Coming Back

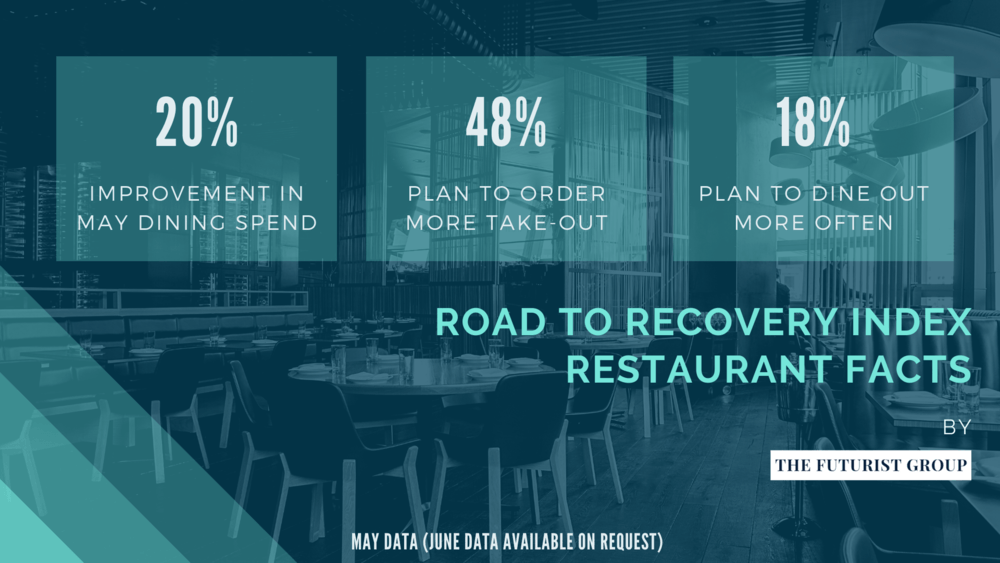

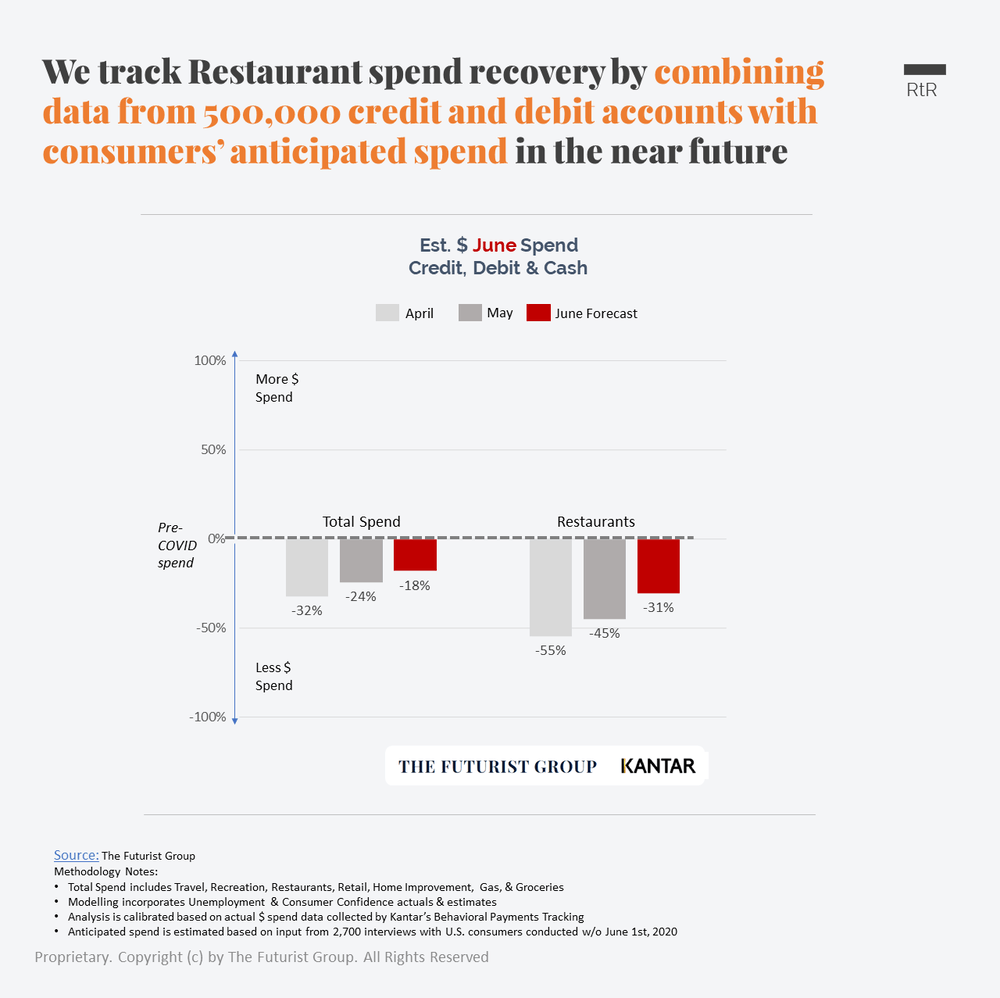

In the month of April, Restaurant spend declined by 55% compared to pre-Covid levels. In May, spend improved by 20%, and as states start to re-open, June is looking even better.

Restaurant Facts At A Glance

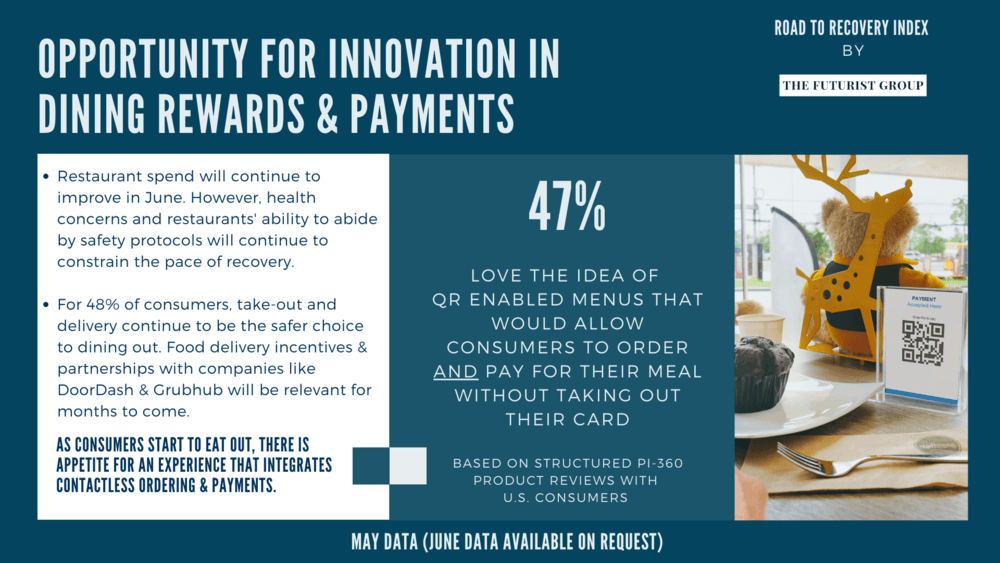

Despite the recovery in spend, the dining industry will continue to experience headwinds.

- With 48% of consumers planning to order more take-out instead of dining out after the state reopens, a full recovery will take some time.

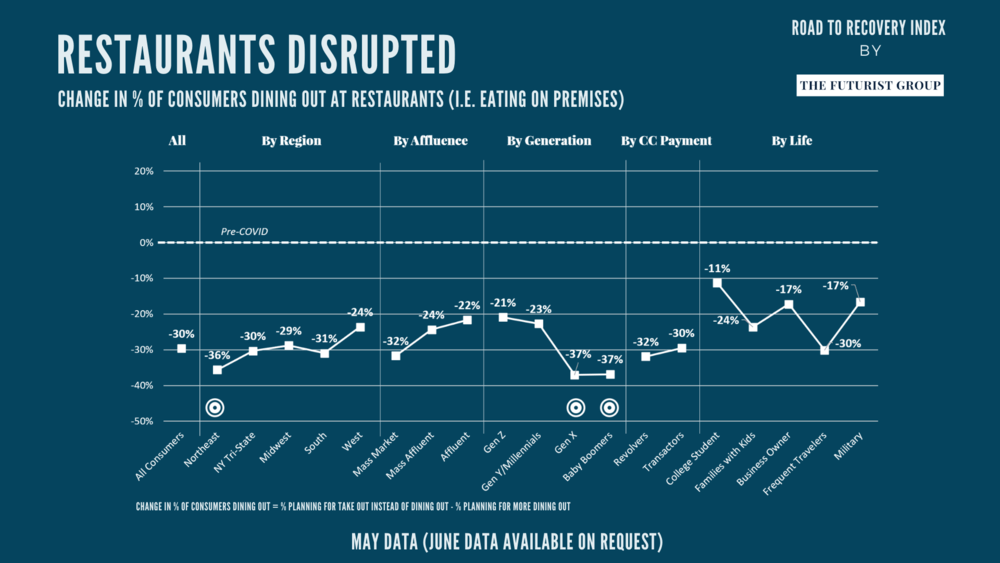

- The disruption to on-premise dining for the next few months is estimated at -30% when compared to pre-Covid levels (i.e., 18% planning to dine out more often - 48% ordering take out instead of dining out = -30%).

- In this transition phase to the next normal, partnerships with food delivery services like DoorDash, Grubhub, and Uber Eats will continue to be relevant.

- In this setting, contactless ordering and payments are an important opportunity for innovation. To evaluate a true integration between ordering and payments we engaged U.S. consumers in product reviews evaluating a QR menu concept that allows patrons to use their mobile device to place an order at the restaurant and then to pay for that order with the same device - 47% of consumers Love this concept and 30% indicated that it would drive primacy for the payment option attached to this concept.

Implications for Business Executives

By understanding and anticipating changes in consumer buying behaviors, businesses can adapt their communication and product strategy to align with consumer needs. Our monthly Road to Recovery Index provides:

- Spend Forecasting: We combine actual credit and debit spend with forward looking consumer sentiment to deliver accurate forecasts that inform business planning and product strategy.

- Consumer Behavior Changes: As the economy and the markets evolve, we offer a window into consumers changing needs and behaviors.

- Product Recommendations: We engage thousands of consumers each month to identify the exact incentives and partnership strategies that drive increased Spend and deeper engagement with your customers.

Inquire about our monthly newsletter or request custom analytics and insights specific to your business:

Contact Us

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Read About Our Road to Recovery Index: The best predictors of future outcomes combine behavioral and economic data with consumer sentiment. This is why we are partnering with Kantar Behavioral Payments Tracking and Pollfish to help our clients evaluate the near-term impact of COVID-19 on consumer expenditures. By combining actual spend patterns with economic and consumer sentiment data, we are creating forward-looking analytics that provide deeper context for where we are today and the path that we will need to take on the Road to Recovery.