June Spend Poised to Accelerate

Subscribe to our Payments Innovation Blog for data and insights on your competitors and customer segments.

Contact Us

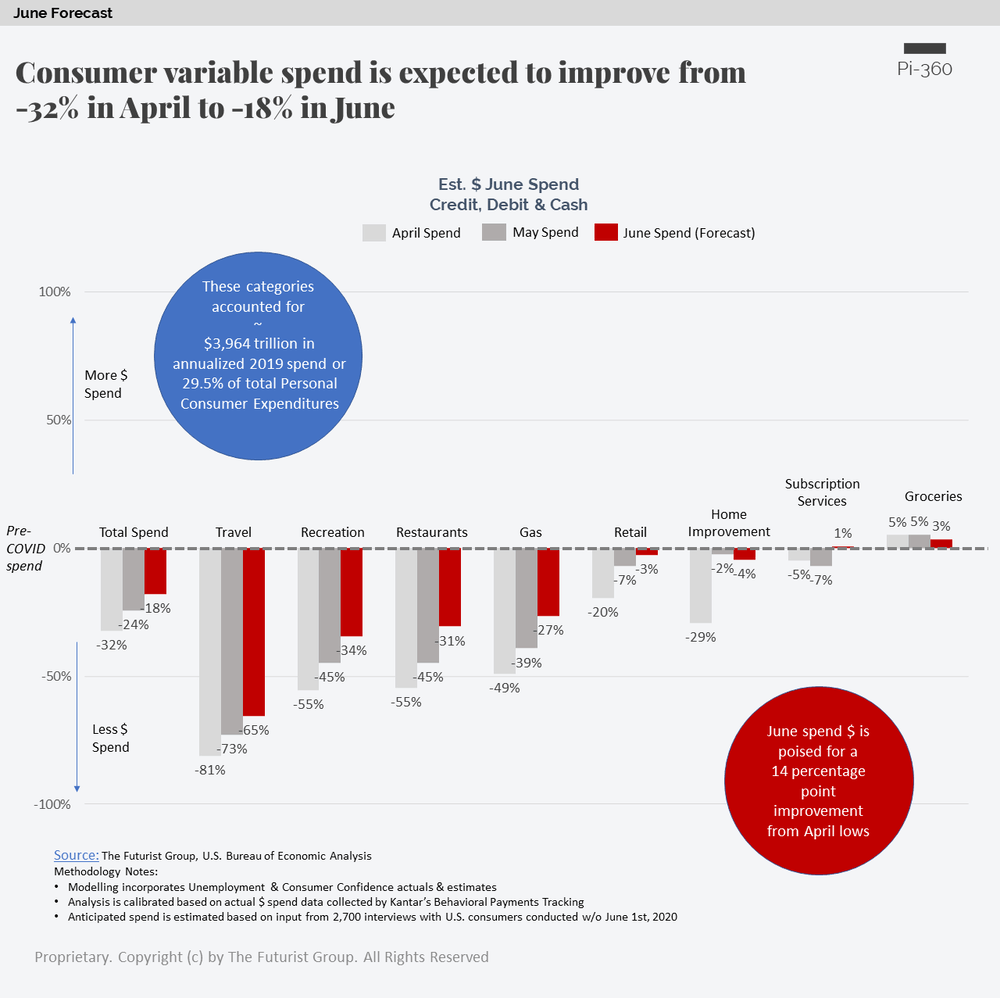

JUNE SPEND IS EXPECTED TO IMPROVE FROM-24% IN MAY TO -18% IN JUNE

Road to Recovery Series

Personal Consumer Expenditures (PCE) account for up to 70% of the total economic output. As we think about the impact of The Great Pause on our Economy, discretionary spend is one of the most important leading indicators of economic contraction and growth.

Our Road to Recovery Index combines actual spend data from ~500,000 credit and debit card accounts collected by Kantar’s Behavioral Payments Panel with economic, consumer sentiment, and payments product data to create a forward-looking mechanism that identifies trends and practical product strategies that preserve and increase payments volume.

Recovery Accelerates in June

With states starting to reopen, consumer spend is about to accelerate across most categories.

KEY TAKEAWAYS:

- Biggest improvement in spend is expected in the Restaurant and Gas categories.

- Travel Spend will see moderate improvement. While 69% of consumers are planning to travel after restrictions ease, 45% are planning road trips, and only 17% are planning to book a hotel. See our Road to Recovery Index | Travel Facts.

- Retail spend will continue to improve to -3% vs. same time last year. Most of the transaction volume will continue to depend on eCommerce. Inquire about our Road to Recovery Index | Retail Facts.

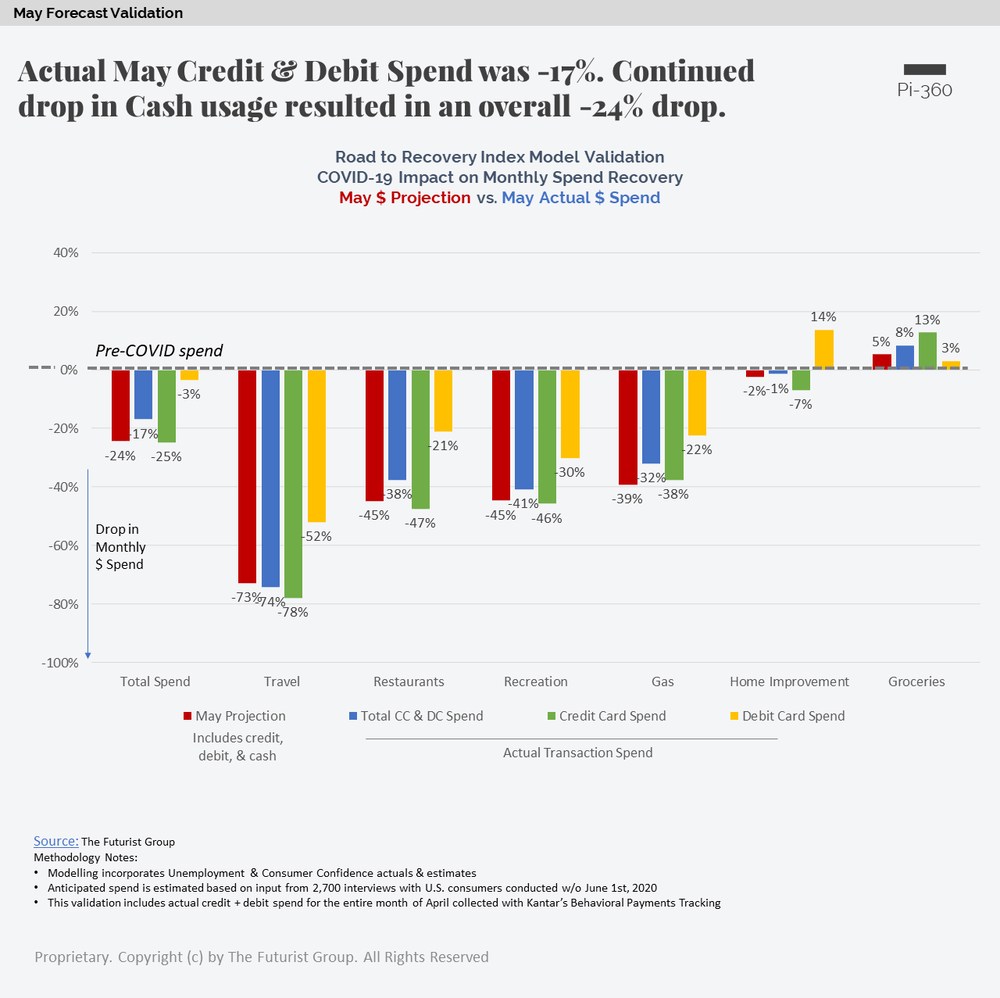

Validation is Everything

With actual spend now available for the first 4 weeks of May, we are able to validate our May projections.

KEY TAKEAWAYS:

- May projections for all categories have proved accurate.

- Debit card spend continued to outperform credit card transactions.

- Actual credit + debit spend has declined 17%. The additional margin of 7% is attributed to a decline in Cash usage, as is evidenced by a 20% decline in ATM withdrawals since the beginning 2020.

Pi-360 | The Road to Recovery Index

By understanding and anticipating changes in spend behaviors, businesses can adapt their communication and product strategy to align with consumer needs.

Our monthly Road to Recovery Index research provides:

- Accurate $ Spend forecasting: We combine actual credit and debit spend with forward looking sentiment to derive accurate forecasts that will help you plan for the near future.

- Ongoing & anticipated shift in consumer behaviors. For every sector covered, our data will help you understand how consumer plans are changing over time.

- Product communication & innovation intelligence. Leveraging our Pi-360 platform, we can identify the exact features, benefits, rewards, and overall mix of incentives that will drive share of wallet primacy and deeper engagement with your customers.Inquire about our monthly newsletter or request custom analytics and insights specific to your business:

Analysis notes:

- Our spend category definitions are focused on how consumers evaluate their purchasing. This is an important distinction, as our categorization may be different from merchant-level categorization employed by financial institutions as well as categorization employed by the U.S. Bureau of Economic Analysis.

- In addition to the commonly accepted discretionary spend categories, such as Travel, Recreation, and Restaurants, we have opted to break-out Subscription Services as a separate category. This category includes all aspects of the subscription economy, such as streaming, meal-kit delivery services, and publications.

- Given the impact that The Great Pause is having on the overall food industry, we have also decided to include Grocery shopping in our analysis.

- The expense categories covered in this analysis have accounted for approximately ~$3.96 trillion in 2019 consumer expenditures or ~29.5% of total PCE.

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Sources for this blog: The Futurist Group, U.S. Bureau of Economic Analysis