Innovation in Motion: 18-34 Preferences Before Covid

Winds of Change Are Not Abating

The cover picture for this blog is a photo of Drinker’s Bar in Philadelphia and their wall of 1000+ lost credit and debit cards. Wouldn’t it be a great idea if a credit card offered a feature that allowed you to find your lost card?

Cover image is courtesy of Philadelphia Inquirer and Joe Crouse.

We are in the business of capturing consumer preferences for every Payments feature, benefit, and evolving product strategy in the market. The idea is simple. The pace of change in the Payments industry has created an urgent need for product managers to adapt the ways in which they approach product design and product marketing innovation.

Business leaders can no longer afford to wait for competitive intelligence, product design feedback, and consumer segment insight. Now, more than ever, we need proactive, accurate, detailed, and prescriptive context about our markets - and we need this context at the speed of business. Unfortunately, while behavioral data is increasingly accessible, consumer insight used to take too long to gather and aggregate. As a result, product managers like you have been dealing with significant blind spots that force you to make decisions based on incomplete information.

We are mapping the entire competitive landscape, including every major core and Fintech product, and we are layering this information with detailed, evolving, and on-demand consumer insight.

The result is our Pi-360 Platform that puts product innovation intelligence at your fingertips.

- Imagine being able to identify which features in your portfolio need to be emphasized for target segment acquisition vs. EMOB usage without needing to go into research or A/B testing!

- Imagine knowing what your competition and new entrants are doing well to attract YOUR target segment without needing to wait for research!

- Imagine being able to drill into any product or any feature category and identify clutter vs. real innovation in time for your next meeting!

- Oh…. and imagine testing your new product idea or messaging, and evaluating your results against our hyper-relevant benchmarks!

To date our platform has captured consumer feedback on more than 2,000 Payment features and benefits, spanning more than 700,000 consumer feature evaluations.

Recently, after delivering a recommendation for a new credit card value proposition, our client asked us about how often consumer Payment preferences change. The answer is that under normal conditions, consumers’ drivers of choice and usage do not and should not change frequently. However, we are not living through normal conditions. Covid has had a massive impact on consumer behaviors and priorities, and that is impacting preferences for what consumers value today vs. what they valued before Covid.

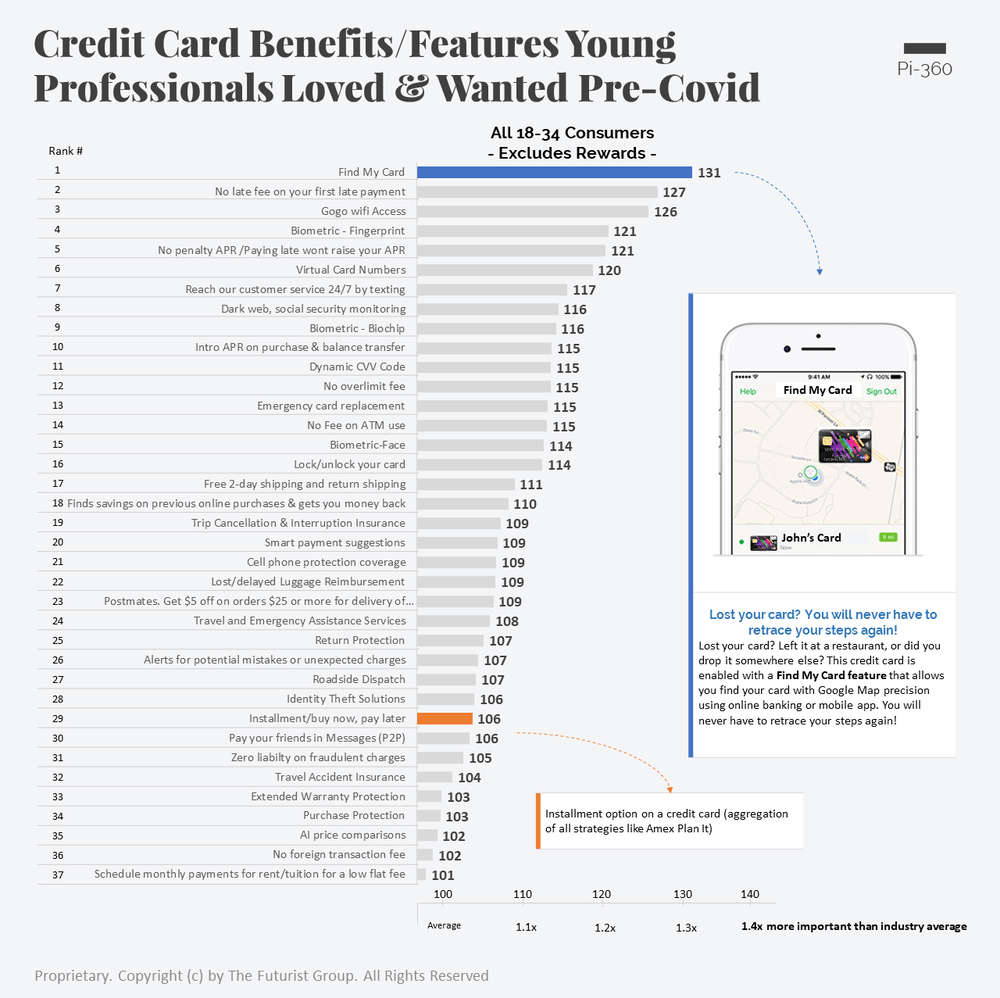

Case in point, take a look at the relative credit card feature preferences among 18 to 34 year olds before Covid. The #1 feature was a new concept that allowed consumers a better way for finding their lost credit card. This simple but brilliant innovation addressed a real-life pain point and simplified an extensive card replacement process for anyone who has ever left their credit card at a bar or restaurant, or simply dropped their card at a friends place.

Needless to say, when we leverage our interactive platform to look at consumer preferences and unmet needs today, the Find My Card option is no longer at the top of the list.

Over the last 6 months, virtually every aspect of the value proposition including Rewards, Terms, Money Management, Security, Experiences, and Customer Service has seen shifts in consumer preferences creating opportunity for innovation and competitive differentiation.

Our clients have real-time access to what consumers value most today and what they are likely to need tomorrow. Schedule a Demo today.

Contact Us

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Sources for this blog: The Futurist Group, TechCrunch, Forbes