Travel Spend Plateaus During The Summer Months

Travel & Recreation Spend Plateaus In The Summer Months

Road to Recovery Series

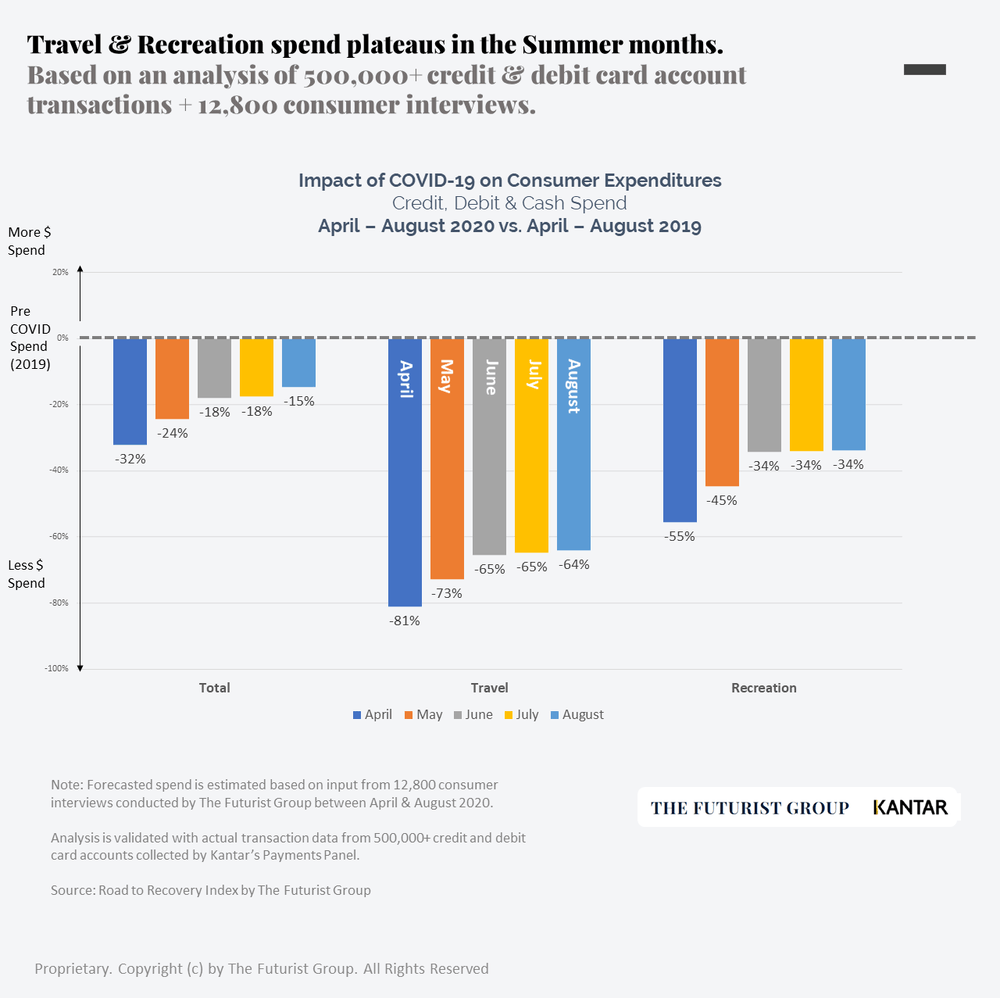

Personal Consumer Expenditures (PCE) account for up to 70% of the total economic output. As we think about the impact of Covid on our Economy, discretionary spend is one of the most important leading indicators of economic contraction and growth.

Our Road to Recovery Index combines actual spend data from ~500,000 credit and debit card accounts collected by Kantar’s Behavioral Payments Panel with economic, consumer sentiment, and payments product data to create a forward-looking mechanism that identifies trends and practical product strategies that preserve and increase payments volume.

Travel & Recreation Spend Slows New Paragraph

- After showing significant improvement in May and June, Travel & Recreation Spend plateaued in July & August.

- Given that the Summer months are typically the peak of vacation season, this data shows that localized road trips and vacation home rentals can only do so much for these belabored sectors.

Trouble Ahead?

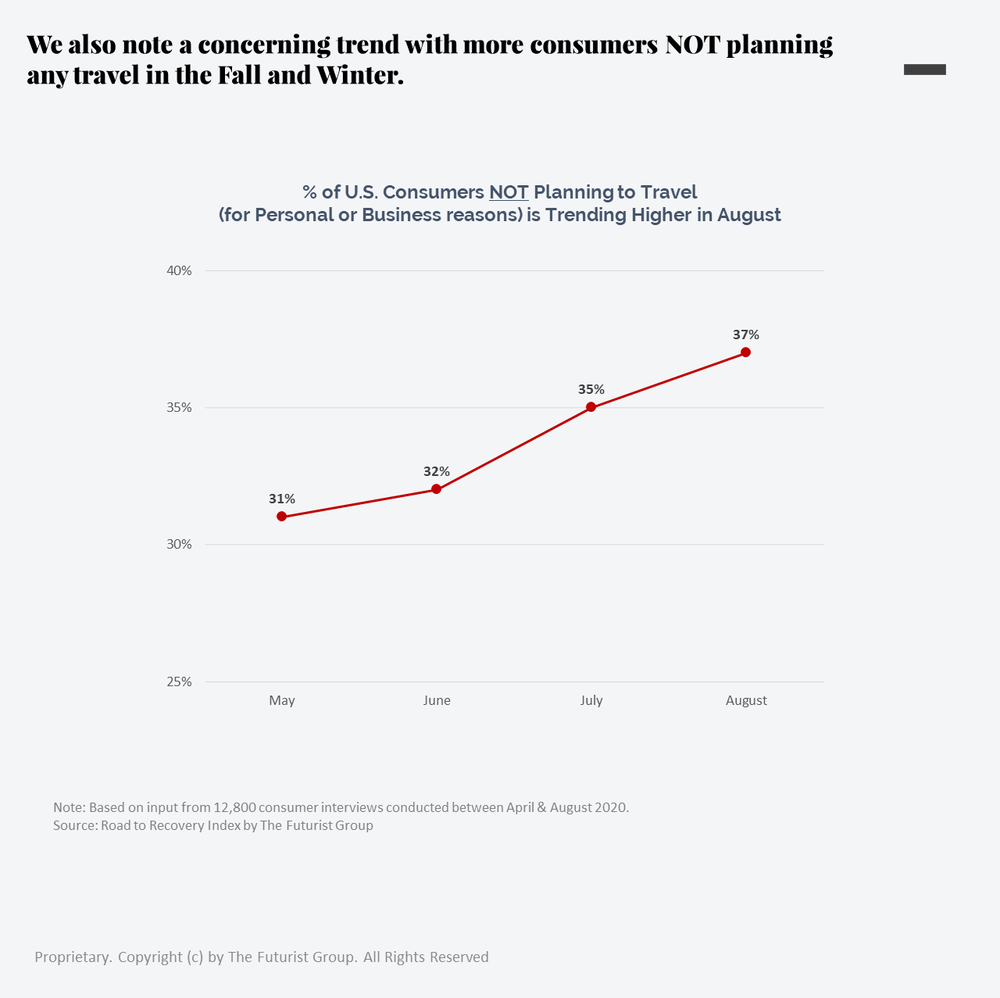

- As the Summer winds down, 37% of U.S. consumers are indicating that they will not do any personal or business travel between now and the rest of the year.

- Couple this with the rising rates of COVID infections and there is a real concern that recovery in Travel may stagnate for the remainder of the year.

Road Trips & Vacation Rentals

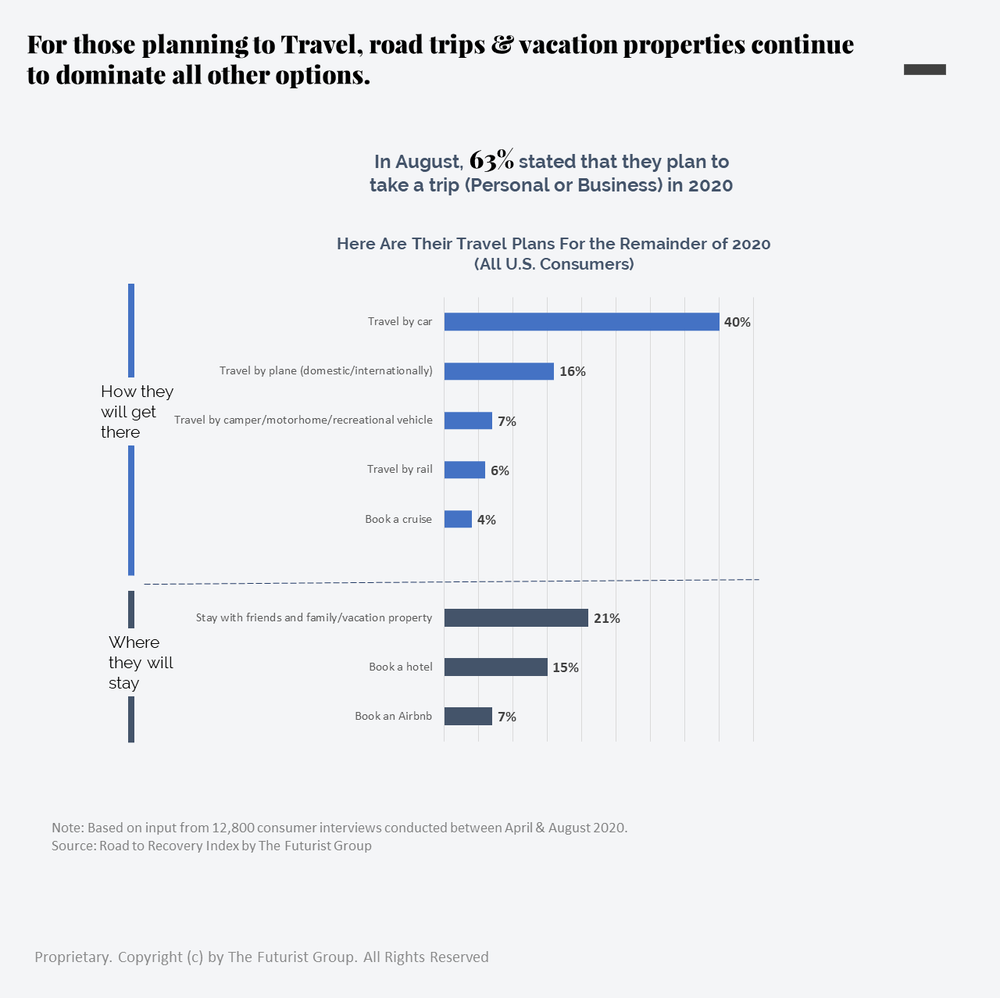

A closer look at consumers’ travel plans for the coming months fuels additional concerns about the rate of recovery. Car trips and staying at vacation homes with friends and family continue to replace air travel and hotel bookings. These preferences have stayed remarkably consistent over the last four months.

Pi-360 | The Road to Recovery Index

By understanding and anticipating changes in spend behaviors, businesses can adapt their communication and product strategy to align with consumer needs.

Our monthly Road to Recovery Index research provides accurate Spend & consumer behavior forecasting for Travel, Recreation, Retail, Dining, Groceries and Home Improvement sectors.

Clients can access trend information and consumer insights across 40+ consumer segments (e.g., Levels of Affluence, Age, Credit Worthiness, Small Business Ownership, Students, etc.).

Contact Us

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Sources for this blog: The Futurist Group, U.S. Bureau of Economic Analysis