May Spend, Signs of Spring Recovery

Subscribe to our Payments Innovation Blog for data and insights on your competitors and customer segments.

Contact Us

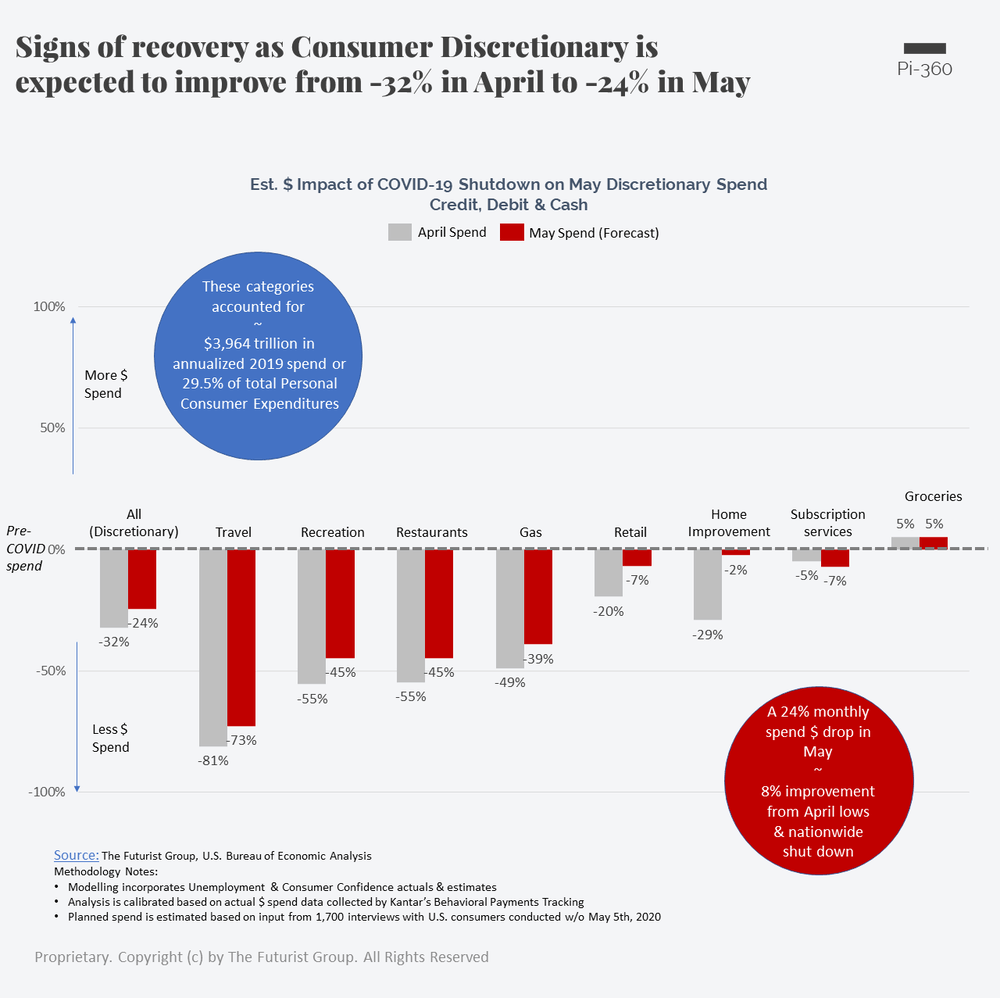

Signs of recovery

Discretionary Spend is expected to improve from -32% in April to -24% in May

Road to Recovery Series

Personal Consumer Expenditures (PCE) account for up to 70% of the total economic output. As we think about the impact of The Great Pause on our Economy, discretionary spend is one of the most important leading indicators of economic contraction and growth.

Our Road to Recovery Index combines actual spend data from ~500,000 credit and debit card accounts collected by Kantar’s Behavioral Payments Panel with economic, consumer sentiment, and payments product data to create a forward-looking mechanism that identifies trends and practical product strategies that preserve and increase payments volume.

Spring Recovery in May

With the national shutdown starting to ease across parts of the U.S., consumers intend to spend more.

KEY TAKEAWAYS:

- Biggest improvement in spend is expected in the Merchandise and Home Improvement categories.

- Travel spend will continue to see continued contraction at -73%.

- Gas, Recreation, and Dining spend are all expected to improve by ~10%.

IN THE FULL REPORT AVAILABLE FOR TFG CLIENTS:

- The month of May forecast is showing pronounced Spend differences by Age, Income, Geographic Region, and Payments Profile (i.e., Transactor vs. Revolver).

- In addition, we are monitoring near-term and long-term behavioral trade-offs in Recreation (Dining, Entertainment, & Fitness), Shopping (Merchandise & Groceries), and Travel.

- Our analysis couples expected Spend patterns with underlying behavioral changes to identify the top 10 incentive strategies that will drive on-going (credit/debit) usage.

- Winning strategies are benchmarked against ~1,400 payments features that have been evaluated by consumers as part our Pi-360, product intelligence and innovation platform.

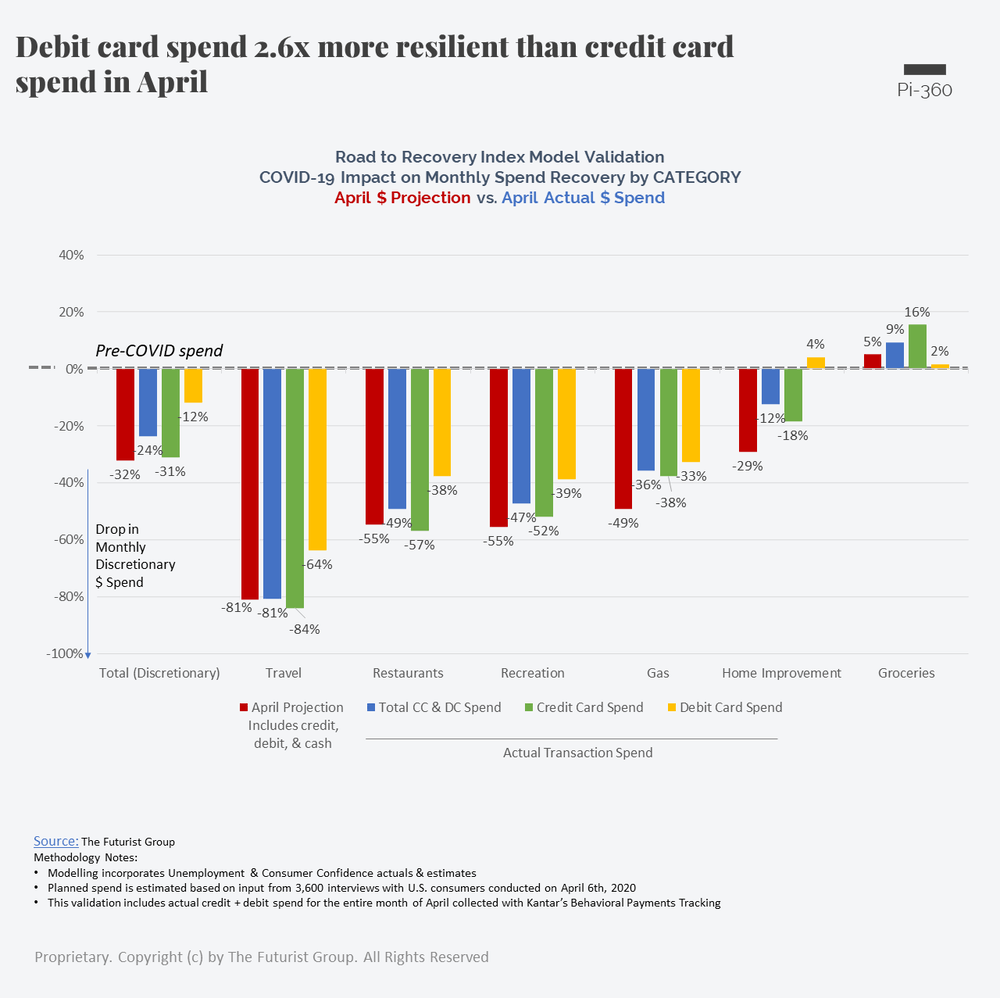

Validation is Everything

With actual April spend now available, we are able to validate our April projections.

KEY TAKEAWAYS:

- In the month of April, debit card spend was 2.6x more resilient (-12%) than credit card spend (-31%).

- Actual credit + debit spend has declined 24%. The additional margin of 8% in our model is attributed to a decline in Cash usage.

- Our projections for Travel, Restaurants, Recreation, Gas, and Groceries have proved accurate.

Pi-360 | The Road to Recovery Index

Inquire about the full report

Contact Us

New Paragraph

What's Next

We will be sharing examples of innovative product communication strategies that acknowledge consumer needs, show compassion, and help you maintain your KPIs in this difficult time.

The insights and data above (and much more) are available across 40+ consumer segments (demographic, behavioral, and attitudinal). If you are developing your strategy now and require practical and efficient assistance, do not hesitate to reach out.

Now, more than ever, Thinking Forward Requires Context.

The Futurist Group Team

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Sources for this blog: The Futurist Group, TechCrunch, Forbes