Future of Contactless: Biochips?

Subscribe to our Payments Innovation Blog for data and insights on your competitors and customer segments.

Contact Us

“Thousands of Swedes are Inserting Microchips Under Their Skin”

The next step in contactless payment evolution, or a step too far for U.S. consumers?

- On March 3rd, The Futurist Group noted a 26% spike in consumers’s consideration of Contactless as a Table Stake Payments feature.

- On April 30th, Visa reported that Contactless payments have spiked by 40% globally.

- In this article, we review Biochips as one potential path for Contactless innovation in U.S. The analysis is based on structured interviews conducted with U.S. consumers before the outbreak of the virus.

In late 2018, Biohax International, a leader in biochip technology, made headlines with their offering of a microchip implant around the size of a grain of rice that can be injected above the consumer’s thumb. The procedure is relatively painless, takes a few minutes, and is administered with a syringe, just like a flu vaccination. In Sweden, the demand for the procedure is so high that the company has been having a problem with keeping up with the number of requests.

Why would anyone want to implant a microchip into their body? Even before COVID-19, one plausible answer was that we live in a world of expected convenience, and for some consumers, any innovation that removes friction from their everyday routine may be worth it. The chip can be used to access homes, offices, gyms, and to pay for everyday small items. In fact, the idea of microchipping is so accepted in Sweden, that the state-owned transit system is accepting biochip payments for transit fares.

Back in January of 2020, long before coronavirus propelled contactless payments from a ‘nice to have’ ancillary benefit to a ‘must-have’ table stake, we at The Futurist Group asked a simple question: are U.S. consumers ready for a contactless Biochip payments product?

At the time, we were compelled to understand how U.S. consumers’ reaction to Biochipping compares against the many Biometric payment options available on the market. Our hypothesis was that this concept was too early for the U.S., as consumers would be too worried about invasion of privacy and potential health concerns.

To give Biochipping a fair chance in our test, we’ve created a product concept that borrows all the details that Biohax advertises as key benefits and combined them with what would be considered by American consumers a rich cash back rewards offer. We also made sure to emphasize that the use of microchips for implants has been deemed safe by the FDA since 2004.

We then included the Biochip Pay concept product in our Pi-360 product review process where thousands of U.S. consumers are providing structured reviews on offers from all major banks and fintech disruptors.

The results are fascinating.

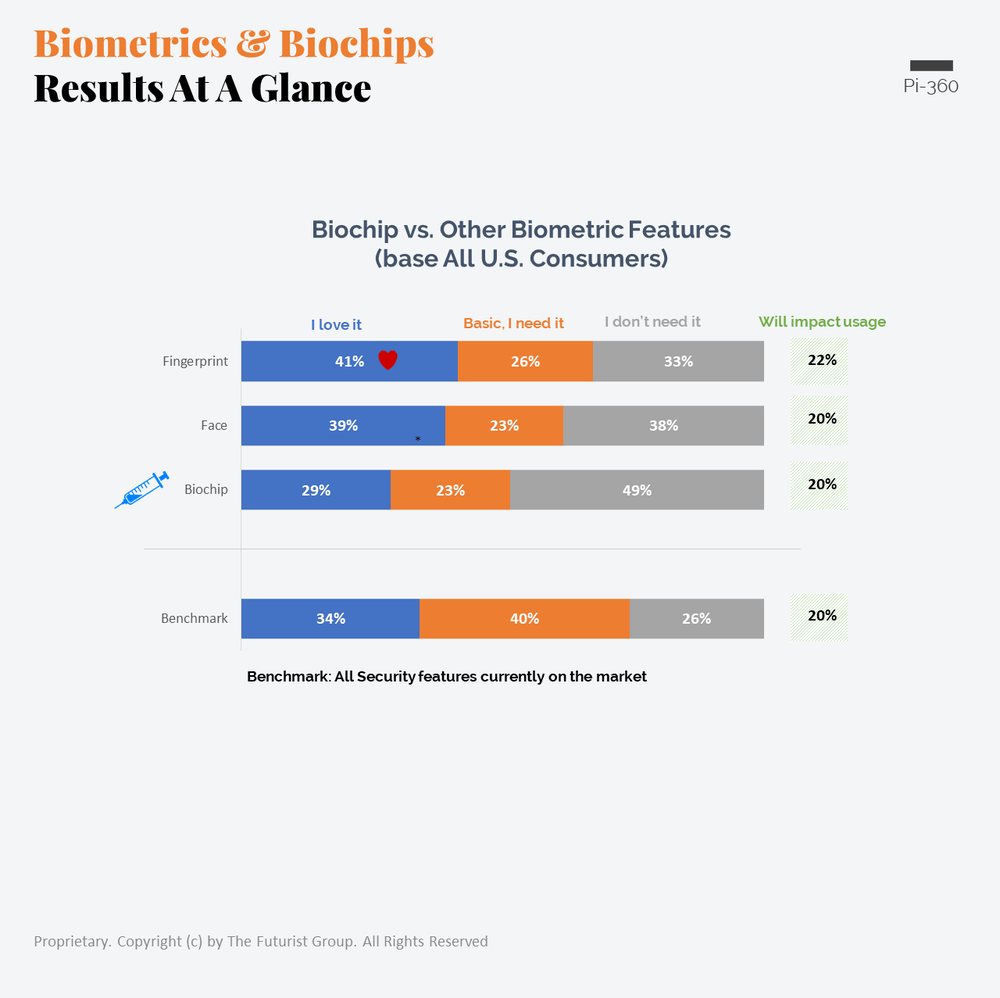

As expected, the Biochip is less appealing to the U.S. consumer than Fingerprint and Facial recognition. What is surprising, is that when combined with rich rewards, 29% of the population find the Biochip idea appealing.

Still, one needs to proceed with caution with concept as 49% of the population flat out reject the concept.

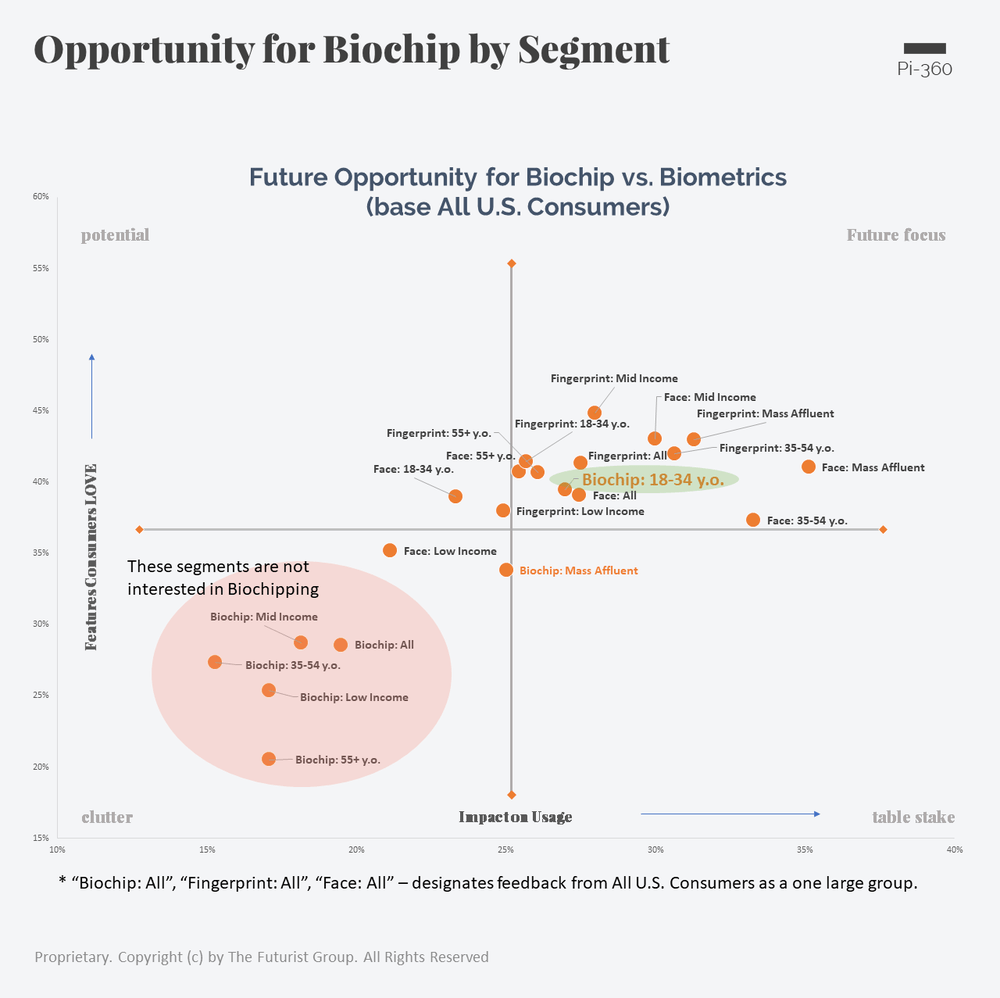

If the general U.S. consumer was not interested in Biochips, but 29% of the population liked the idea, who is interested? To answer this question we mapped out consumers’ evaluation of the Biochip feature and the other common Biometrics on two dimensions: % of Consumers Who Love the Feature & the potential of the feature to Impact Usage of the embedded credit card.

The results are telling. Young people (18-34 years of age) are open-minded enough to consider this type of an offer.

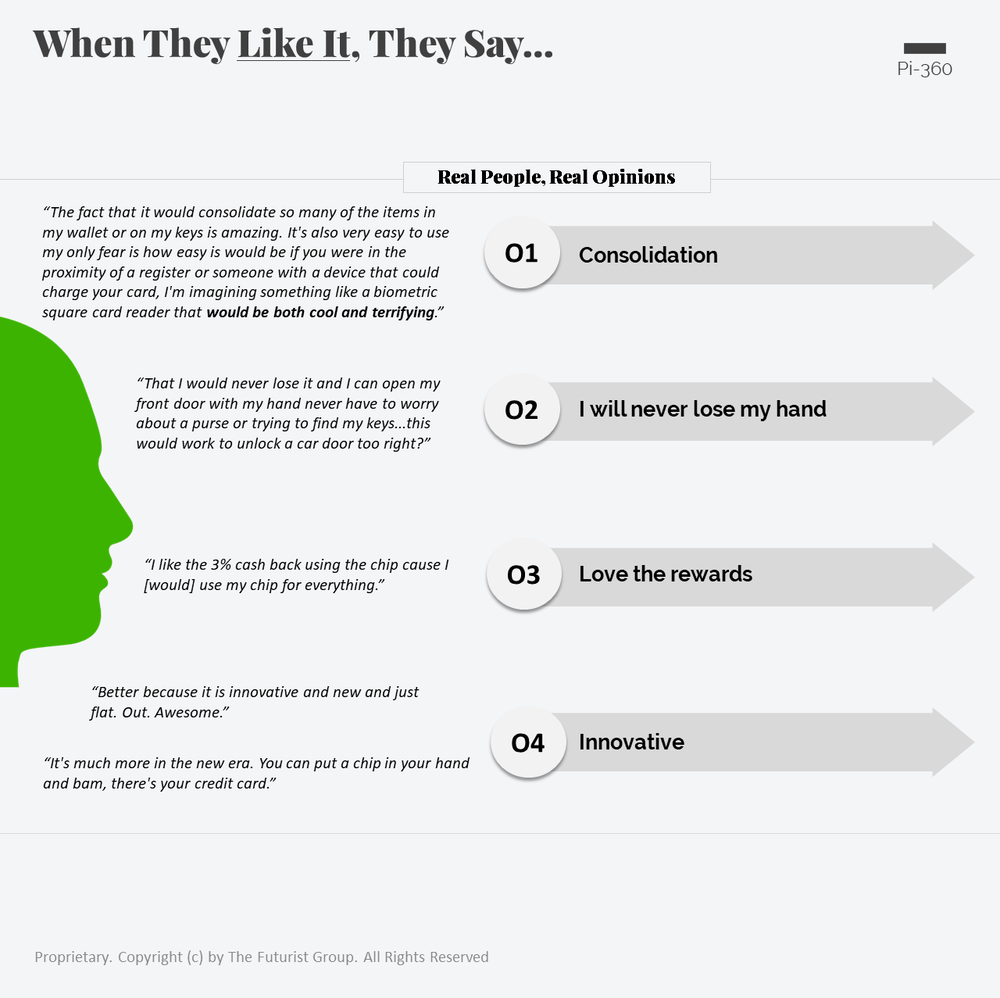

When we analyze the comments provided with each consumer review, we note both the excitement about the offer as well as a degree of concern. The convenience factor resonates loud and clear for early adopters of this concept.

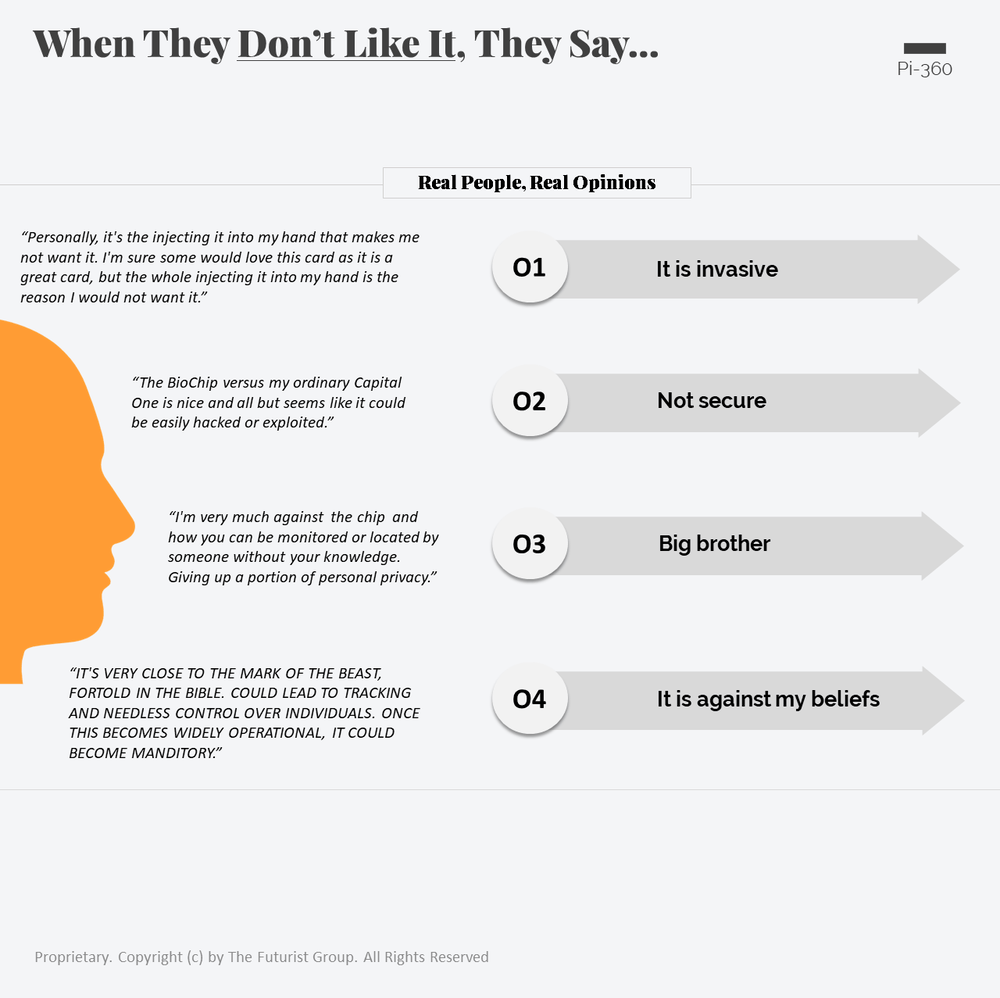

The sentiment against Biochips is very strong among rejectors. The invasiveness of the procedure, concerns about privacy, and strong comments noting that the idea of an implant violates religious beliefs, highlights the divisiveness of this offer.

Looking Ahead

In January of 2020, the idea of Biochips seemed like the stuff of science fiction. In May of 2020, it certainly feels like we are living in a new world where the need for contactless convenience is everything for consumers and merchants alike.

Pre-COVID evaluation of Biochips, suggest that there is an opportunity for this feature in the U.S. market, particularly for younger consumers.

That said, this is a highly controversial and divisive concept and any advances need to adequately address consumers’ concerns.

Even in January, one of the most important observations from this analysis was the realization of how much Younger consumers crave convenience in everyday routines. The idea of never having to worry about losing one's credit card being important enough to inject a microchip into one's hand, speaks volumes about this demographic and the whitespace opportunity for innovation.

What’s Next

Interested in more information about the present and future of contactless and biometric payments? We have an immense amount of consumer data on every payments feature and innovation in the market, including:

- Contactless for credit cards (impact on adoption vs. usage, etc.)

- Connected Car for Gas purchases

- Connected Car for Food Pickup

- Mobile Apps for Contactless Payments

- Fingerprint Biometrics embedded in credit card plastic

- and much more…

Contact Us

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Read About Our Road to Recovery Index: The best predictors of future outcomes combine behavioral and economic data with consumer sentiment. This is why we are partnering with Kantar Behavioral Payments Tracking and Pollfish to help our clients evaluate the near-term impact of COVID-19 on consumer expenditures. By combining actual spend patterns with economic and consumer sentiment data, we are creating forward-looking analytics that provide deeper context for where we are today and the path that we will need to take on the Road to Recovery.

Sources: The Futurist Group, Kantar Behavioral Payments Tracking