March Newsletter

Subscribe to our Payments Innovation Blog for data and insights on your competitors and customer segments.

Contact Us

Preserving Payments Volume & Other March Trends

For over a year, we have been building a platform for benchmarking and analyzing the Payments landscape through the eyes of the Consumer.

Throughout March, a month that has re-shaped the global economy, we have used our platform to identify emerging trends faster than any traditional method that we have seen in our careers.

By combining three data sources at scale:

- feature / benefit-level product intelligence on all core and fintech products

- innovation intelligence on product concepts that have not yet entered the market, and

- structured product feedback from thousands of consumers

our platform is consistently delivering leading indicator insights on consumers’ rapidly evolving needs and the practical “so what do I do now?” product actions that can preserve payments volume.

Prior to COVID-19, we identified two key trends in Payments:

- Rewards have peaked. In preparation for a market downturn, our data showed that providers can no longer compete with a Rewards-only strategy

- Benefit marketing is the next frontier. We showed that there are significant differences across consumer segments in the types of benefits that they desire, and the relative importance of each benefit category in impacting product acquisition and usage.

In March, we were the first to note emerging trends in:

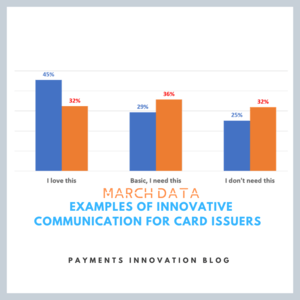

- A shift in consumers’ Benefit priorities that can preserve payments volume

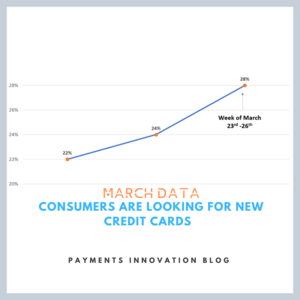

- Credit Card seeking behavior

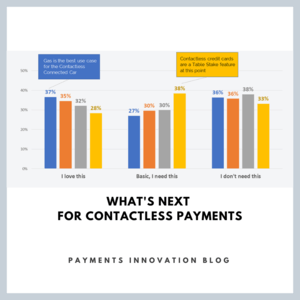

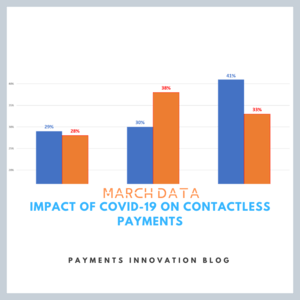

- Increasing appetite for Contactless Payments

In case you missed any of these important insights, here they are again:

We want to hear from you

We would like to hear your questions. What topics are of most importance to your business? With our agile platform, we deliver insights with market context & consumer benchmarks within 48 hours of your request.

Now, more than ever, Thinking Forward Requires Context.

The Futurist Group Team

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Sources for this blog: The Futurist Group, TechCrunch, Forbes