Innovation in Times of Crisis

Examples of Innovative Credit Card Communication Ideas In Times of Crisis

If you acknowledge consumer needs & show compassion, you can preserve your KPIs in this difficult time.

In speaking with clients across the Payments and broader Financial sector over the last few weeks, all agree that our current situation is unlike any other recession or downturn ever experienced. While some of us who have worked through the Great Recession in the financial services sector try to draw parallels to the hardships of 2008 and 2009, there is a resounding agreement that the actions that we need to take today, and tomorrow, as business leaders are in many respects unique. While the Great Recession was a systematic financial crisis that caused doubt in our largest and most established financial institutions, 2020 is a healthcare crisis that is impacting the very essence of what we hold dear; our lives and the lives of our loved ones.

In this time, if you are a payments leader thinking about your portfolio, you are likely considering the following:

- How do I support my customers in a sensitive and relevant manner?

- As spend decreases across most merchant categories, how do I preserve my KPIs?

- What is appropriate, if anything, to communicate to my customers at this time?

- Is it safer to take my time and follow suit with the rest of the industry with standard communication (e.g., fee forgiveness etc.)?

Our data shows that is absolutely possible, and necessary, to offer Innovative product communication and support during this time. While we are evaluating dozens of strategies, what makes our effort unique is our ability to benchmark every benefit and feature communication against every Payments feature that is currently on the market. This is why we are confident in stating that in our current environment, smart & innovative communication will establish you as a leader, will drive long term loyalty with your customers, and help your preserve payments volume in the process.

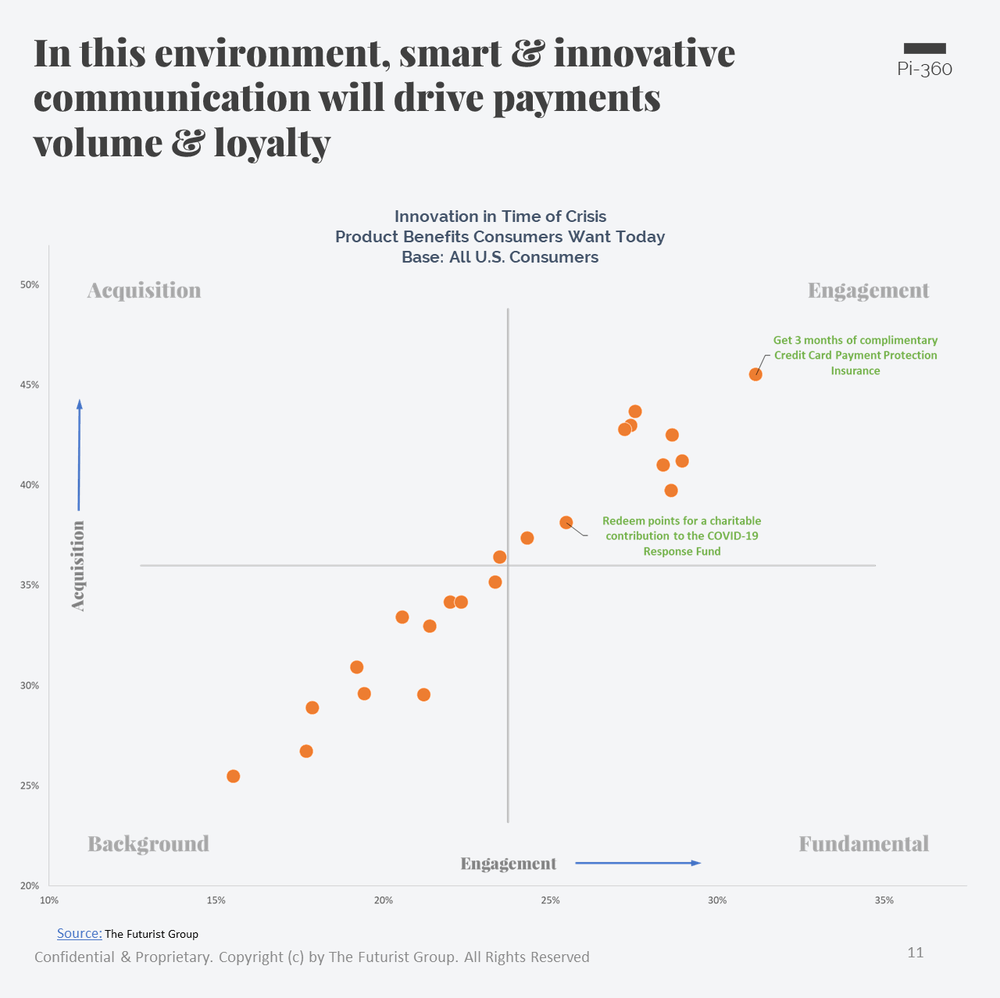

Here are 2 ideas that are testing well with consumers right now:

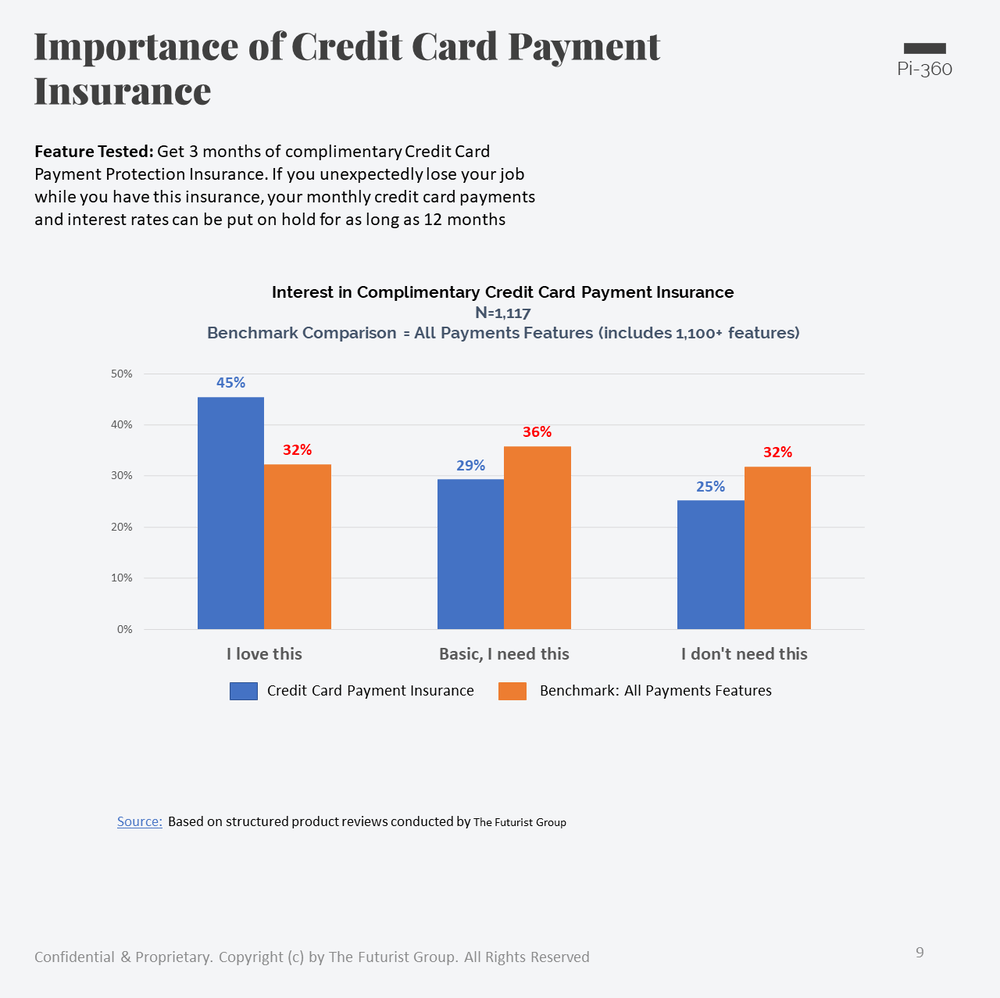

- Emphasize Credit Card Payment insurance. If possible, offer the insurance at no cost for a defined period of time.

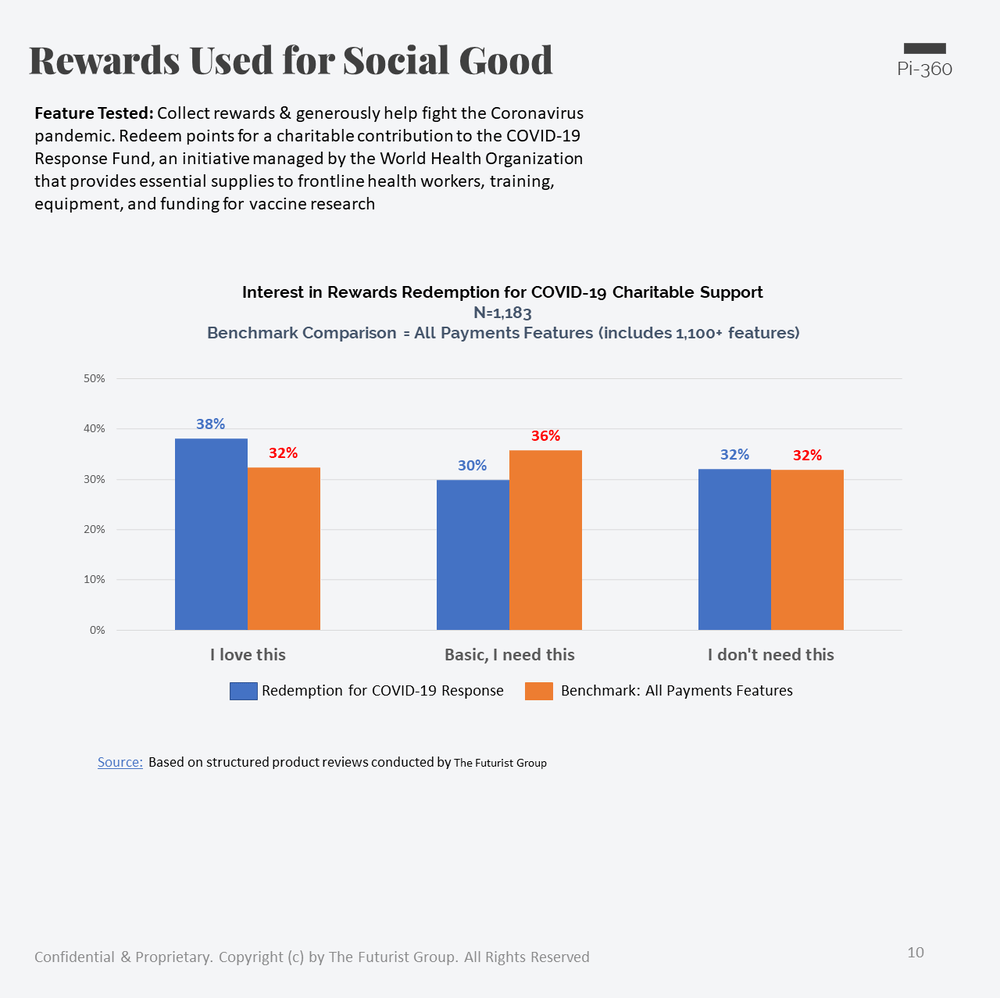

- Not everyone requires Fee Forgiveness at this time. Pivot your Rewards and offer Charitable donation to help fight COVID-19.

In evaluating these benefits with thousands of U.S. consumers this week, both of these concepts perform better than the benchmark that includes everything that is currently on the market.

We are big advocates of having a strategy that is tailored for different consumer segments, but at the same time speaks to everyone in your customer base. Both of these ideas are relevant for specific segments while connecting with your entire customer base.

CLICK THROUGH TO SEE BOTH SLIDES:

In this environment, we need to be practical. While Social Good and Financial Support strategies are of paramount importance, anything that you offer needs to be viable for your portfolio. Beyond understanding what consumers want and need right now, you need to understand how your effort will impact behavior.

For every single strategy that we evaluate, we assess the degree to which a benefit is likely to impact usage of your product. In the chart below, where Y-Axis represents impact on product acquisition, and X-Axis represents impact on product usage, notice that both of the strategies mentioned in this blog are performing above average on both metrics.

We are here to help

The insights and data above (and much more) are available across 40+ consumer segments (demographic, behavioral, and attitudinal). If you are developing your strategy now and require practical and efficient assistance, do not hesitate to reach out.

Now, more than ever, Thinking Forward Requires Context.

The Futurist Group Team

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About PI-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Sources for this blog: The Futurist Group, TechCrunch, Forbes