Innovation in Motion: Save Now to Buy Later - Reel

Emerging Trend & Opportunity For Responsible Buying - Save Now to Buy Later

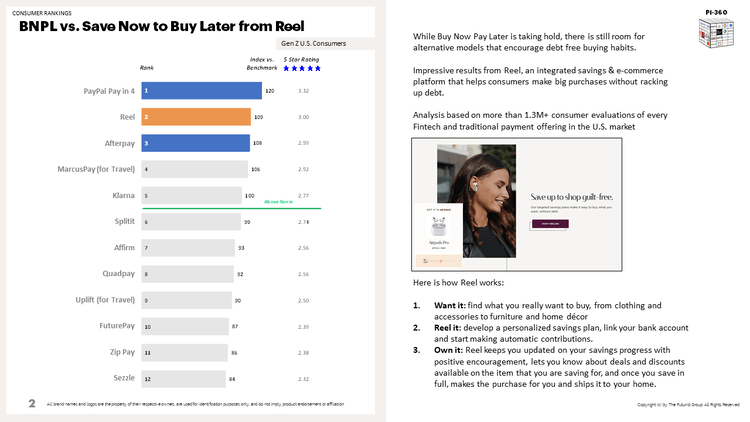

As the Buy Now Pay Later (BNPL) sector continues to dominate the news cycle, we see evidence of consumer traction for a new trend of responsible buying. A trend that we will call Save Now to Buy Later (SNBL).

For years, the savings rate in the United States was in a state of free fall, hitting an all time low of 2.2% in July 2005. While the Great Recession reversed this trend, the Pandemic caused an unprecedented surge in savings.

One of the important underlying stories of the Great Recession is the lasting impact that it had on young adults. In the U.S., the unemployment rate of young men peaked at 19.8% in 2009. Living through what is now their second recession, many young consumers are looking for digital-first financial tools and providers who will help them gain control over their finances.

With this context in mind, our platform has identified Reel (https://app.joinreel.co/) as one SNBL company that is rapidly gaining traction with U.S. consumers.

We had an opportunity to connect with Daniela Corrente, Reel’s CEO and Co Founder to ask her about the opportunity that she sees for the Save to Buy sector.

“As a society, we have been led to believe that the only way to achieve our goals is to go into debt. The financial system can be incredibly predatory, at times it seems it’s all built to drive us into a vicious cycle of unnecessary debt. Yet, the economic uncertainty we’re all living is now increasing people’s resentment towards a debt-driven, paycheck to paycheck mentality. The timing for Reel is right, consumers are already asking for mindful payment solutions that adapt to their financial realities, while retailers and brands are standing in the crossroad of evolution or death by stagnation. Reel is showing people that saving towards the things they want to buy is the first step towards achieving a better financial future. Whatever it is, a new computer, a pair of shoes, a comfy couch, we’re making it easy for everyday Americans to achieve their aspirations on their terms and without the anxiety that debt generates. By connecting savings with shopping, we’re easing people into feeling more comfortable with their own cashflow, while helping them unlock their true consumer power.”

— Daniela Corrente, REEL CEO and Co Founder

PI-360 is the only real-time innovation intelligence platform designed to identify Payments Innovation trends before they take hold. Our data combines the deepest competitive insights on every core and fintech product with 1,300,000+ consumer evaluations of every payment feature and innovation in the U.S. market.

PI-360 interactive platform delivers these insights on-demand and in time for your next meeting.

Contact Us

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About PI-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Sources for this blog: The Futurist Group, Reel, Journal of Family & Economic Issues: Economic Conditions of Young Adults Before and After the Great Recession, U.S. Bureau of Economic Analysis