July Spend Stagnates

Subscribe to our Payments Innovation Blog for data and insights on your competitors and customer segments.

Contact Us

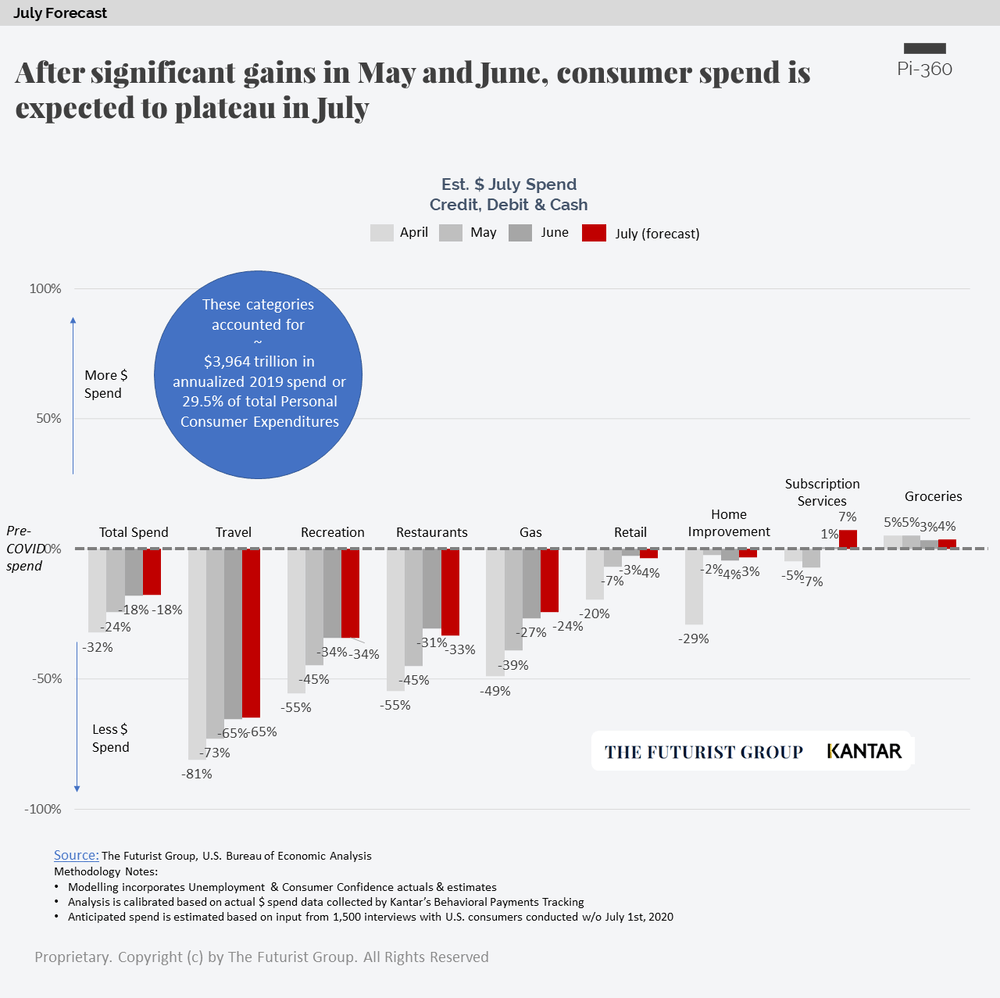

Spend is Expected to Plateau in July

Road to Recovery Series

Personal Consumer Expenditures (PCE) account for up to 70% of the total economic output. As we think about the impact of the pandemic, discretionary spend is one of the most important leading indicators of economic contraction and growth.

Road to Recovery Index Model forecasts consumer spend as a function of past spend patterns across ~500,000 credit and debit accounts, economic markers, and forward-looking consumer sentiment.

These forecasts are in part defined by consumers indicating their anticipated spend given the current state of their local economy and their personal financial situation. Before providing input, consumers consider the latest news related to COVID, the impact on local businesses, the state of re-opening or closures related to the pandemic, and other factors.

This grounded evaluation combined with analysis of actual spend patterns creates forecasts that have proven to be highly accurate and validated by data from the US Census Bureau.

Recovery Plateaus in July

With a rise in COVID infections in 46 states at the time of writing, improvement in consumer spend stagnates.

KEY TAKEAWAYS:

- Overall spend that includes cash, credit and debit is expected to stay flat vs. June.

- While the slow down in spend is concerning, it is encouraging that at this time consumers do not anticipate retrenching to May or April lows.

- As conditions change, and a post-July 4th infection spike is likely, this forecast will be reviewed with additional consumer sentiment collected week of July 15th.

Pi-360 | The Road to Recovery Index

By understanding and anticipating changes in spend behaviors, businesses can adapt their communication and product strategy to align with consumer needs.

Our monthly Road to Recovery Index research provides:

- Accurate $ Spend forecasting: We combine actual credit and debit spend with forward looking sentiment to derive accurate forecasts that will help you plan for the near future.

- Ongoing & anticipated shift in consumer behaviors. For every sector covered, our data will help you understand how consumer plans are changing over time.

- Product communication & innovation intelligence. Leveraging our Pi-360 platform, we can identify the exact product strategy that will drive deeper engagement with your customers.

Contact us for more information:

Name

Contact Us

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

Road to Recovery Index: The best predictors of future outcomes combine behavioral and economic data with consumer sentiment. This is why we are partnering with Kantar Behavioral Payments Tracking and Pollfish to help our clients evaluate the near-term impact of COVID-19 on consumer expenditures. By combining actual spend patterns with economic and consumer sentiment data, we are creating forward-looking analytics that provide deeper context for where we are today and the path that we will need to take on the Road to Recovery.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Sources for this blog: The Futurist Group, U.S. Bureau of Economic Analysis, NPR - Tracking The Pandemic: Are Coronavirus Cases Rising Or Falling In Your State?